54.12.1 There are two ways to write-off (full or partial amount) an invoice and that is either by creating a negative invoice or applying a discount. Both methods will zero out the balance of an invoice but each method is presented differently on some reports.

54.12.2 Apply Discounts

Open the Client or Job/Project screen -> click Invoice tab

Locate the Invoice

On the same row where the Invoice Reference is shown, further to the right is the Receipt column showing the total Receipts applied, double-click to open the Receipt screen

If the invoice has no previous receipts you get a blank receipt screen

If there was a previous receipt, click the add new record button to get a blank receipt screen. The add new record is a small button at the bottom left of the screen. It's a small arrow pointing to the right with a star/asterisk '*'

Select a Bank Account, Client Code, Enter Receipt Date, Payment Method and Details

Enter zero ($0.00) in Receipt Amt

On the 1st row of Receipt Details section, enter the Discount Amount

Click OK when asked to enter GST Type

Click OK to acknowledge the Error: 3021

Select a Discount Expense Account

Select Tax Type

Select (by double-clicking) the invoice to apply the Discount

Click Close button

Press F9 on the keyboard to refresh the Invoice tab

54.12.3 Apply Receipt and Discount at the same time

Open the Client or Job/Project screen -> click Invoice tab

Locate the Invoice and double-click the Receipt column

If the invoice has no previous receipts you get a blank receipt screen

If there was a previous receipt, click the add new record button to get a blank receipt screen. The add new record is a small button at the bottom left of the screen. It's a small arrow pointing to the right with a star/asterisk '*'

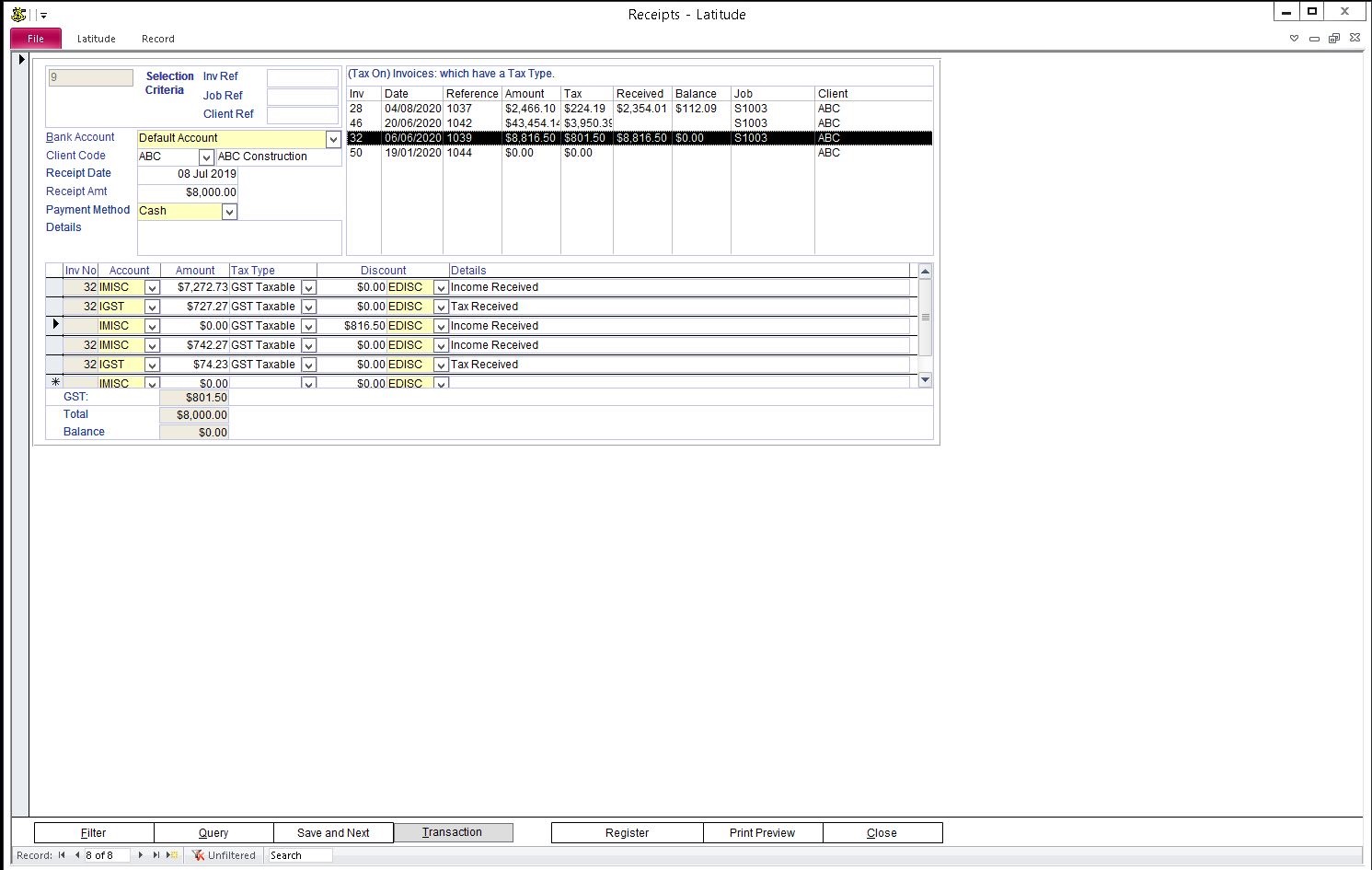

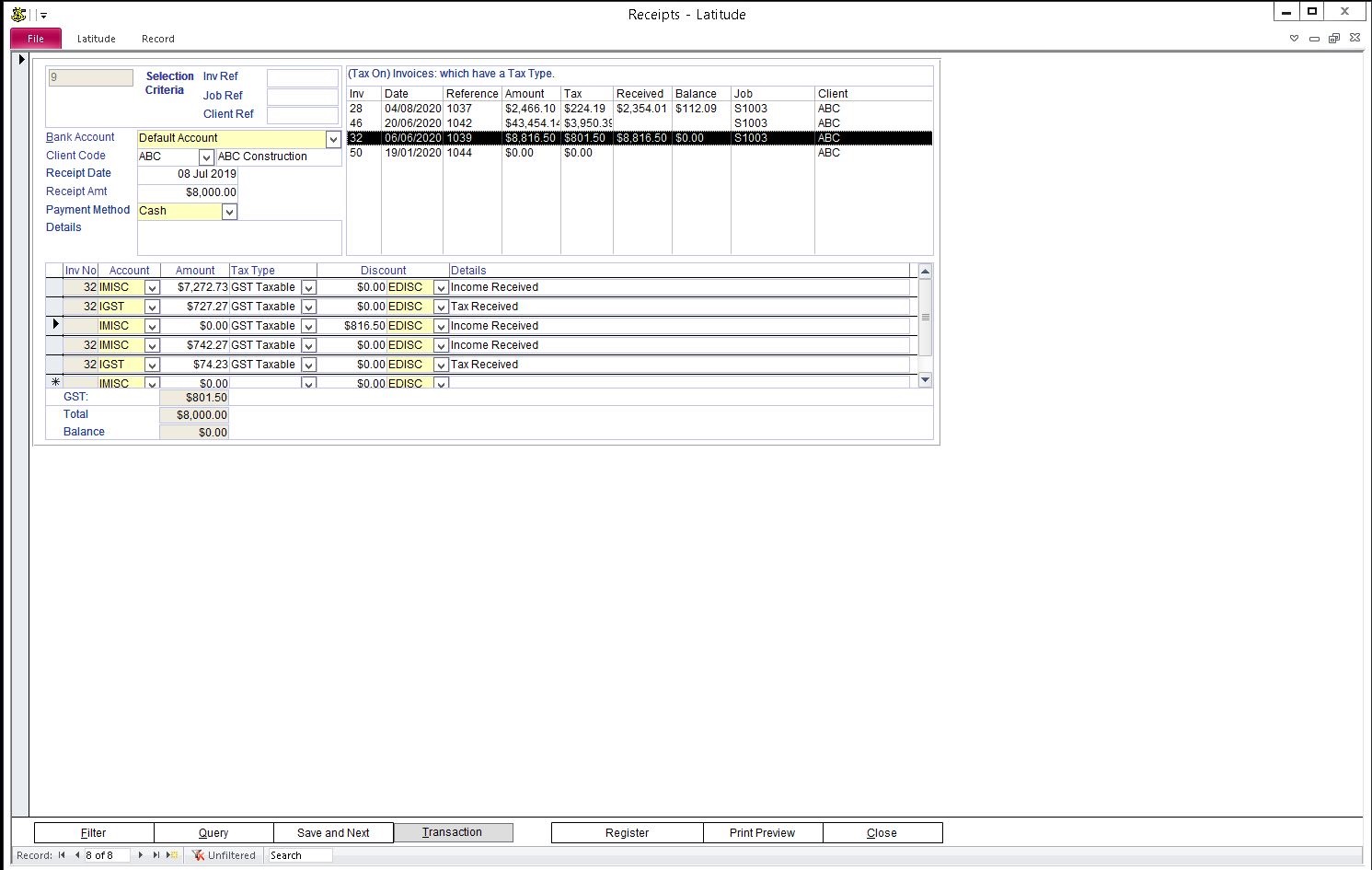

Select a Bank Account, Client Code, Enter Receipt Date, Payment Method and Details

Enter the Balance less the discount amount (e.g. $2,200 Total Invoice Amt – $200 Discount = $2,000) in Receipt Amt

On the list of Invoices (top right), select (by double-clicking) the invoice to apply the receipt and discount for

On the 3rd row of Receipt Details section, enter the Discount Amount

Click OK when asked to enter GST Type

Click OK to acknowledge the Error: 3021

Select a Discount Expense Account

Select Tax Type

Select (by double-clicking) the invoice to apply the discount

Click Close button

Press F9 on the keyboard to refresh the Invoice tab

54.12.4 Creating Credit Note (ie. Write-off) using a negative Invoice

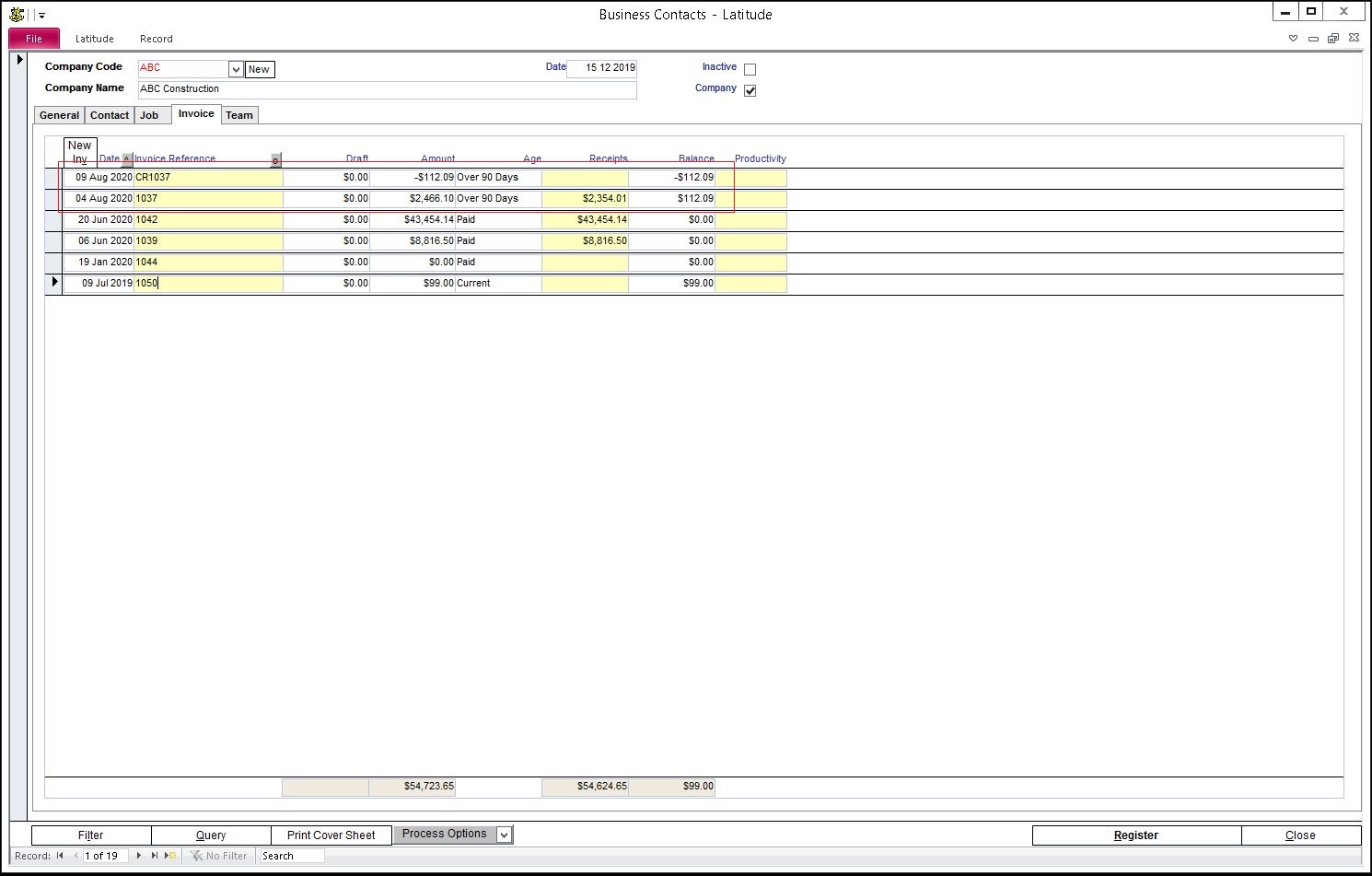

Open the Client or Job/Project screen -> click Invoice tab

Click the "New Inv" button

On the Reference field, enter the "Credit Number" in the invoice number. To easily link it to an invoice, use the following convention "CR<invoice number>" where the invoice number is the invoice you want to apply this credit to

On the first Multi-line, click the Total field

Latitude prompts to save the invoice, click Yes

On the Total field, enter the negative amount that you want to write-off and press enter key

Enter in multi-line Details like 'credit note' or some descriptive text

Click Close & press F9

Accounting Link Note

QuickBooks does not support importing negative invoices (displays the error "Transaction must be positive."). Therefore you need to create the negative invoices (ie. credit notes) directly into QuickBooks as Credit Memo.

Go to a Customer

Click New Transactions -> Credit Memos/Refunds

Enter the line details and amount

Click "Use credit to apply to invoice" button and select the invoice you want it applied

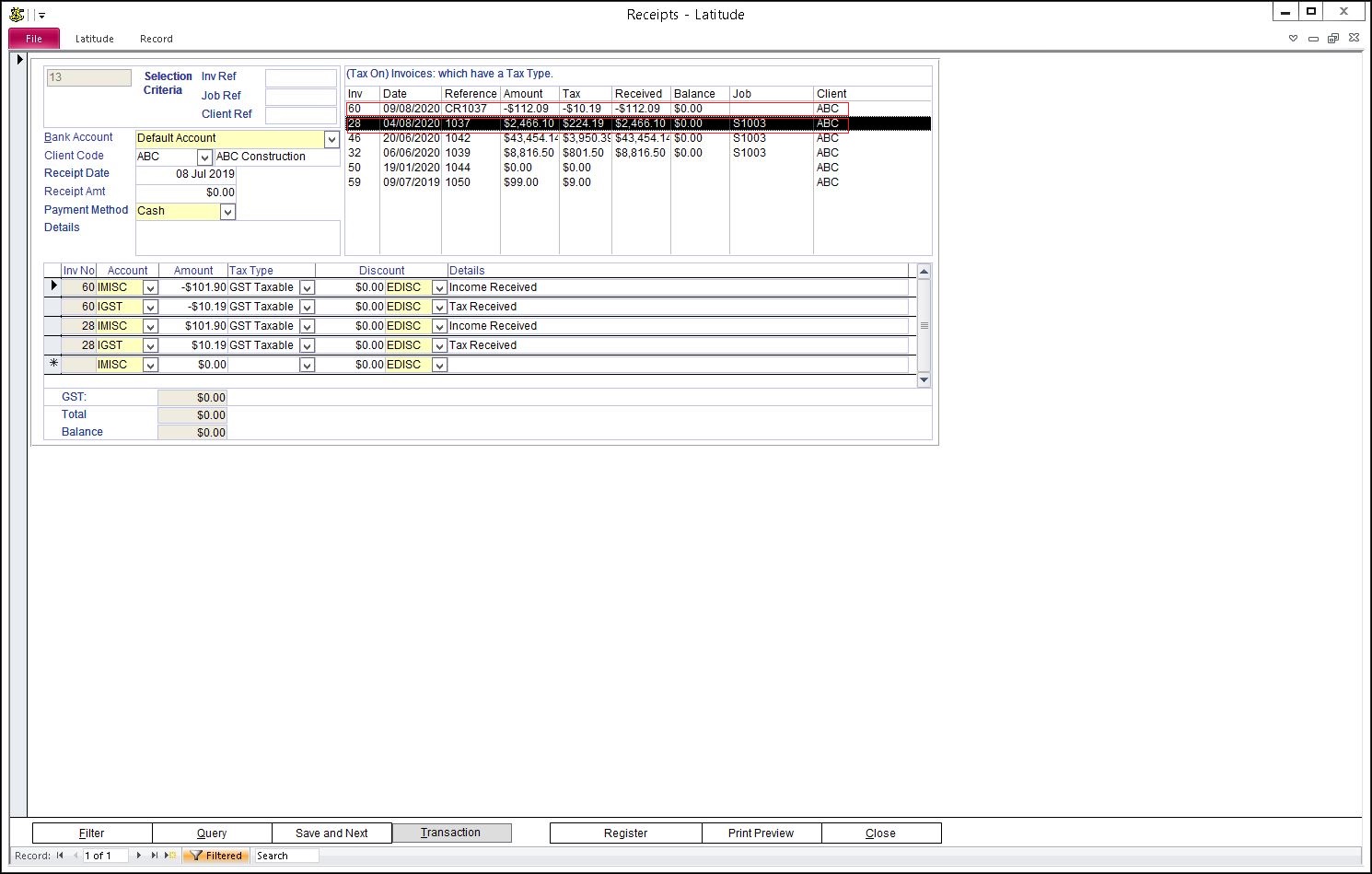

54.12.5 Applying Credit Note to an invoice (ie. Write-Off)

Open the Client or Job/Project screen -> click Invoice tab

Locate the Negative invoice and double click on the Receipt column to display a blank receipt

Select a Bank Account, Client Code, Enter Receipt Date, Payment Method and Details

Enter zero ($0.00) in Receipt Amt

On the list of Invoices (top right), double-click on the Negative invoice first

Double click the invoice that has the positive balance amount

Click Close & press F9