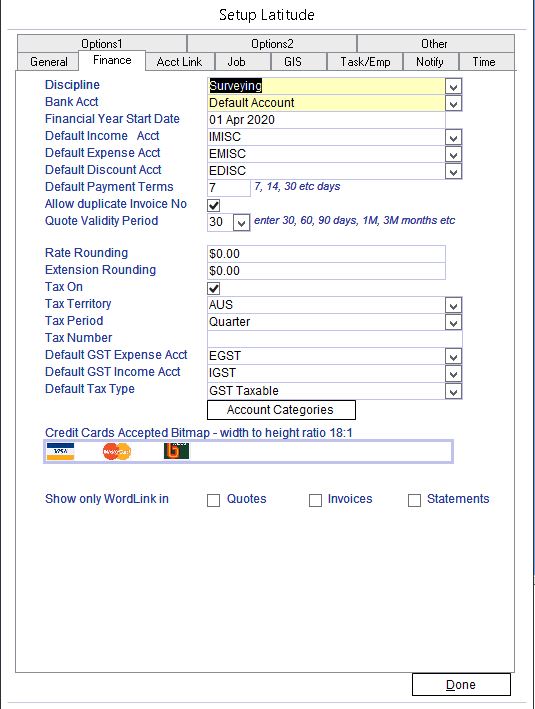

9.3.1 Select "Finance" tab

9.3.2 Select the discipline of your business

9.3.3 Select a Bank Account. The account selected here will be used as a default account in finance related features in Latitude such as Receipts, Payments and Bank Reconciliation.

9.3.4 Enter the start date of your current Fiscal year / Financial year

9.3.5 Select your default account category for Income, Expense and Discount e.g. IMISC, EMISC, EDISC

9.3.6 Enter Rate rounding and Extension rounding if you want to round your Rate and Extension, for example to $0.50 or $1.00. If you want exact figures, enter $0.00

9.3.7 The other fields on the tab relate to Tax

Tax On - Tick if your country has a Tax such as Goods and Services Tax (GST) or VAT. If not, leave it unchecked. If 'Tax On' is ticked, select your Tax Territory, Tax Period and Default Tax Type.

Select "EGST" as Default GST Expense Acct. and "IGST" as Default GST Income Acct.

If these Accounts do not appear in the drop down list, close Setup

From the Main Menu click the Account Categories button and enter them

When done, Open Setup again and select these accounts.

9.3.8 Show only WordLink when previewing quotes, invoices & statements. This option hides the built in (non-WordLink) quote, invoice & statement templates.